Did you know that 70% of online users never scroll past the first page of search results?

If your insurance business isn’t ranking high, you’re missing out on potential clients. You can boost your visibility and attract more customers with the right insurance SEO strategies.

This article explores the essentials of insurance SEO and explains how it can elevate your online presence. You’ll learn practical tips for optimizing your website and improving your search rankings.

Using tools like Auto Page Rank can simplify your SEO efforts and ensure your site gets indexed efficiently. While some competitors offer basic services, Auto Page Rank stands out with advanced features tailored to your needs.

Get ready to discover how adequate insurance SEO can transform your business. Let’s explore strategies to help you shine in a crowded market.

Understanding Insurance SEO

Insurance SEO refers to the strategies used to improve the online visibility of insurance businesses. This process focuses on optimizing websites to rank higher in search engine results and attract more potential clients.

What Is Insurance SEO?

Insurance SEO involves specific tactics tailored for the insurance industry. It involves making your website friendly to both search engines and users. Key elements include keyword research, content creation, and link building.

Keyword research uncovers terms people use when searching for insurance products.

Content creation provides valuable information in articles or blog posts. These resources help potential clients make informed decisions.

Link building involves acquiring links from reputable sites to prove your site’s trustworthiness. The ultimate goal is to increase organic traffic.

Importance of Insurance SEO for Agencies

Insurance SEO holds significant importance for agencies. With 70% of users not scrolling past the first page of search results, capturing that prime real estate is crucial.

Agencies that implement effective SEO strategies can see improved online visibility. This means more clicks, inquiries, and, ultimately, clients.

Insurance is often a complex topic, and good SEO helps simplify it for potential customers.

It presents information in a straightforward format, making it easier for clients to find what they need.

Moreover, you can establish credibility through informative content, setting yourself apart from competitors.

Utilizing tools like Auto Page Rank helps agencies track their SEO performance efficiently. It provides insights that guide your strategy, helping you stay competitive.

Ready to boost your insurance SEO? Check out Auto Page Rank for tools that make tracking and improving your performance easy.

- Neil Patel on SEO Basics

- MMoz’sGuide to SEO

- Search Engine Journal on SEO Trends

Key Strategies for Effective Insurance SEO

Effective insurance SEO relies on various techniques to stand out in search rankings. Following these strategies can guide your business toward improved visibility online.

Keyword Research for Insurance SEO

Keyword research lays the foundation. You pinpoint the phrases potential customers type into search engines. Use tools like Google Keyword Planner or Ahrefs for insights.

Consider long-tail keywords like “affordable car insurance in California,” which draw targeted traffic. Think about common questions your prospects ask. Examples include “How much does home insurance cost?” This approach helps you align content with user intent.

Tack on regional modifiers. Using terms like “best insurance agents in New York” can help capture local traffic.

Auto Page Rank can assist in tracking keyword performance. You can also identify keyword gaps compared to competitors.

On-Page SEO Techniques

On-page SEO techniques shape your site’s content and structure. Focus on relevant title tags and meta descriptions. Use concise language that speaks directly to users’ needs.

Break up text with headers and bullet points for easy readability. This layout invites more interaction. Google favors sites with a good user experience.

Incorporate internal links. They guide users to related content. It increases page views and lowers bounce rates.

Images mark another crucial element. Always use alt text with your photos. It helps search engines understand your content better.

Using Auto Page Rank, you can analyze on-page SEO factors such as load time and mobile-friendliness. These metrics can refine your strategy.

Off-Page SEO Strategies

Off-page SEO strategies build credibility beyond your site. Focus on link-building campaigns. High-quality backlinks from reputable sites signal trust to search engines.

Consider guest blogging opportunities. Write valuable content for other insurance-related sites. This can earn you backlinks and expose your brand to new audiences.

Utilize social media platforms. Share valuable content that engages your followers. Please encourage them to share your brand’s message. More shares mean more traffic—incredible, right?

Monitor your online reputation. Reviews on platforms like Google My Business can influence potential customers. Responding to feedback shows you value client input.

Auto Page Rank helps track backlinks and identify top-performing content. It’s essential for maintaining a competitive edge.

Each strategy, from keyword research to off-page activities, contributes to a more substantial SEO presence in the insurance market. Implementing these techniques can create a reliable roadmap for visibility.

Common Challenges in Insurance SEO

Navigating the realm of insurance SEO presents specific hurdles unique to the industry. Understanding these challenges helps you craft effective strategies to boost your online presence.

Identifying Target Audience

Identifying your target audience can feel like searching for a needle in a haystack. You might think you know who your customers are, but diving deeper reveals a more complex picture.

Utilize demographic data, behavior analytics, and surveys. Look closely at age groups, income levels, and interests. For example, recognizing that younger clients often seek online quotes can influence your marketing direction.

Users value personalized content. Tailor your website’s language and offerings to speak directly to their needs. For example, if you offer life insurance, content targeting families with children might resonate better than generic pitches. Tools like Auto Page Rank can enhance your understanding of audience engagement, allowing you to refine your strategies based on real-time data.

Competition Analysis

Competition analysis often feels like staring down a rabbit hole where your competitors seem to have all the aces. Knowing what’s out there gives you a leg up in ranking.

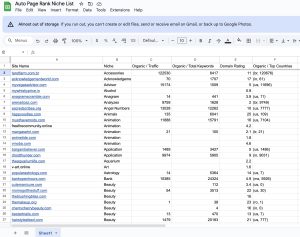

Start by researching competitors’ online presence and keyword use. What phrases are they ranking for? Please take note of frequent topics and phrases around them. If they dominate “affordable car insurance,” identify long-tail variations you could target, like “budget-friendly car insurance options.”

Check backlinks, too. A strong backlink strategy from respected sites can greatly boost your authority. Ask yourself, who links to your competitors? This can reveal partnership opportunities.

Tools like Auto Page Rank help you monitor competitor performance, offering insights that help you steer your SEO efforts smartly and strategically.

Sources for Further Reading

- Moz’s Guide to SEO for Insurance

- HubSpot’s SEO Marketing Best Practices

- Neil Patel’s Complete Guide to SEO

Auto Page Rank can alleviate many of these issues by streamlining your analysis of your audience and competitors, ensuring you’re always a step ahead in the insurance SEO game.

Measuring the Success of Insurance SEO

Measuring success in insurance SEO isn’t just about rankings; it encompasses a broader view of performance, including traffic, leads, and conversions. Analyzing specific metrics can reveal how effective your strategies are.

Key Performance Indicators (KPIs)

Focus on KPIs. Track organic traffic, bounce rate, conversion rate, and keyword rankings. Each figure tells a story about how users interact with your site.

- Organic Traffic: Counts visitors from search engines. A steady increase signals effective SEO tactics.

- Bounce Rate: Measures how many visitors leave after viewing one page. A high bounce rate often indicates content that doesn’t engage.

- Conversion Rate: This shows the percentage of visitors who complete desired actions, like filling out a quote request. A higher conversion rate means your site is doing its job.

- Keyword Rankings: This shows where your targeted keywords rank on search engine results pages. Regularly tracking these positions helps refine your strategy.

Data from reliable sources like Moz and Search Engine Journal can provide insights into benchmarking these KPIs against industry standards.

Tools for SEO Tracking

Utilize SEO tools. Various tools exist for tracking SEO performance. Understanding which one suits your needs will get you closer to your goals.

- Google Analytics: Monitors website traffic and user behavior, offering insights on how visitors find and interact with your site.

- SEMrush Tracks keyword performance conducts SEO audits and provides competitive analysis. Its comprehensive data helps identify strengths and weaknesses.

- Ahrefs: Specializes in backlink analysis and keyword research. Use it to uncover opportunities for link-building

Auto Page Rank and similar software streamline your tracking process. They simplify metrics tracking and give you one-click access to vital data.

Improving your insurance SEO’s success entails focusing on the right metrics and leveraging the appropriate tools. WRobust analytics provide clarity, allowing you to adapt strategies based on data-driven insights.

Key Takeaways

- Importance of Insurance SEO: Effective insurance SEO is crucial for boosting online visibility and attracting potential clients, as 70% of users do not scroll past the first page of search results.

- Key Components: Successful insurance SEO involves keyword research, content creation, and link building tailored specifically for the insurance industry. This ensures that your website meets both user and search engine needs.

- On-Page and Off-Page Strategies: Implementing both on-page SEO techniques (like optimizing title tags and incorporating internal links) and off-page strategies (such as building high-quality backlinks) significantly improves search rankings.

- Utilize Effective Tools: Tools like Auto Page Rank can simplify SEO tracking and performance measurement, enabling insurance agencies to refine their strategies based on real-time data and competitor analysis.

- Metrics for Success: Measuring success in insurance SEO goes beyond rankings; focusing on key performance indicators (KPIs) like organic traffic, bounce rate, and conversion rate helps gauge overall effectiveness and user engagement.

- Stay Competitive: Regularly updating your strategies based on data insights, competition analysis, and audience behavior is essential for maintaining a robust online presence in the ever-evolving insurance market.

Conclusion

Mastering insurance SEO is vital for your business’s success in today’s digital landscape. Focusing on effective strategies like keyword research and quality content creation can enhance your visibility and attract the right clients.

Don’t overlook the importance of measuring your efforts. Tracking KPIs will help you understand how well your strategies work and where to make adjustments.

Embrace the challenges of the insurance market with confidence. With the right approach to SEO, you can stand out from the competition and build lasting relationships with your audience. Start implementing these strategies today and watch your business thrive.

Frequently Asked Questions

What is insurance SEO?

Insurance SEO refers to optimizing insurance-related websites to improve their visibility on search engines. It involves strategies like keyword research, content creation, and link building to attract more clients and rank higher in search results.

Why is SEO important for insurance businesses?

SEO is crucial for insurance businesses because 70% of online users do not scroll past the first page of search results. Effective SEO strategies enhance visibility, attract potential clients, and drive more leads and conversions.

What are some key strategies for effective insurance SEO?

Key strategies include conducting keyword research to identify relevant search terms, optimizing on-page elements like title tags and meta descriptions, and implementing off-page techniques like link building and social media engagement to increase credibility.

How can I conduct keyword research for insurance SEO?

Utilize tools like Google Keyword Planner or Ahrefs to discover relevant keywords. Focus on long-tail keywords and regional modifiers that potential customers search for, allowing you to attract more targeted traffic to your website.

What are the common challenges in insurance SEO?

Challenges include identifying the target audience, conducting competitive analysis, and understanding customer needs. Tools like Auto Page Rank can help analyze demographic data and competitor performance to identify areas for improvement.

How do I measure the success of my insurance SEO efforts?

Success can be measured using key performance indicators (KPIs) such as organic traffic, bounce rate, conversion rate, and keyword rankings. Tools like Google Analytics and SEMrush help track these metrics for data-driven strategy adjustments.

What role does content creation play in insurance SEO?

Content creation is essential for providing valuable information to potential clients, establishing trust, and improving search engine rankings. High-quality, relevant content keeps users engaged and encourages them to explore further, leading to better conversion rates.